When can I sign up for a Medicare Supplement? Your Medicare Supplement open enrollment period starts 6 months before the month you turn 65 and ends 5 months after that month. During this time period you can enroll in any Medicare Supplement policy without health questions. Your coverage will begin the month you start Medicare A & B or turn 65. If you are outside of your open Medicare Supplement open enrollment period, you can apply anytime, you may just need to answer health questions.

Will Medicare Supplements cover me at my doctors & medical providers Standard Medicare Supplement plans cover you at any doctor that accepts Medicare A & B. If your doctor accepts Traditional Medicare A & B, they should also accept a Standard Medicare Supplement with any insurance provider.

Do Medicare Supplements cover pre-existing conditions? Coverage for pre-existing conditions varies with different insurance companies. Many Medicare Supplement insurers cover pre-existing conditions from the start of your coverage. Some Medicare Supplement insurers have a waiting period for pre-existing conditions that can be offset if you have maintained coverage.

Will my Medicare Supplement cost me more if I have pre-existing conditions? No. Premium costs for Medicare Supplements are not based on your health or claims history.

Can Medicare Supplement insurance providers deny coverage for a service or procedure? No. Medicare Supplements cover their part of the costs for all services provided under Medicare A & B. They do not determine if a service or procedure is covered, Medicare does.

Can I be dropped from a Medicare Supplement policy? As long as you pay your premium and keep it up to date, no. Once you are covered by a Medicare Supplement policy it is guaranteed renewable each year and you can never be dropped because of your age, health, or claims history.

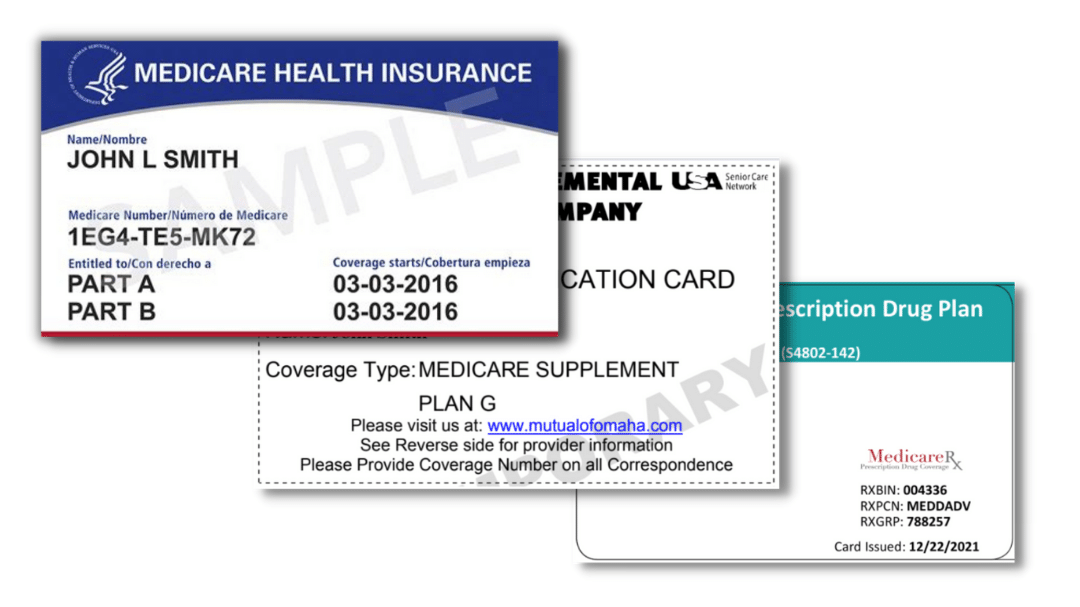

Do Medicare Supplements cover prescription drugs? Medicare Supplements cover their part of costs for services provided under Medicare A & B. Medicare A & B only covers certain medications administered to you at a doctors office or in the hospital. To have coverage for medications you take regularly and fill at the pharmacy, you will need a stand alone Part D plan.

If I don’t take any medications or only a couple, do I still need a Part D prescription plan? It is highly recommended that you enroll in a Part D prescription plan unless you have creditable prescription coverage through another source. If you don’t sign up for a Part D plan when you’re first eligible, and decide to enroll later, you may incur lifetime penalties.

Can my Medicare Supplement rate be increased? The most common way Medicare Supplements are priced is called “attained age” pricing. This means that once you have a Medicare Supplement, your rates can increase each year based on your age when your policy automatically renews. Your Medicare Supplement rate can also increase based on changes to Medicare and rate increases for all insureds in a particular state. You cannot be singled out for rate increases because of your personal health and claims history.

If I choose a Medicare Supplement plan, can I change it later? You can change your Medicare Supplement plan. Keep in mind, if you do, you more than likely will need to qualify and answer health questions.

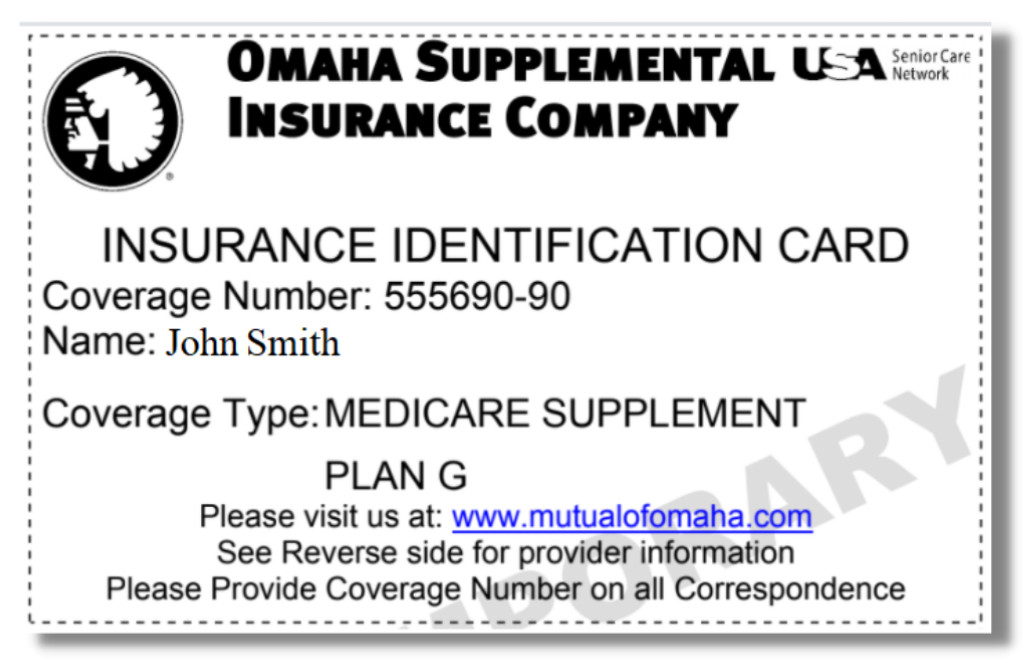

Does it matter which insurance company provides my Medicare Supplement Each Medicare Supplement insurance provider is regulated by Medicare and required to provide the benefits and coverage based on your letter policy. Rates, service, and long term stability varies. It is these reasons why you should compare insurance providers and choose a quality option for your coverage.

What happens to my Medicare Supplement if I move? In most cases, If you move, you can take your Medicare Supplement with you. The coverage and benefits are locked in. The monthly rate you pay, however, may adjust to rates in your new service area.

Will My Medicare Supplement cover me if I’m traveling? Yes. Medicare Supplements work with Medicare A & B to cover you at any Medicare Approved doctor in the country. This includes when you’re traveling and have an emergency or if you schedule an appointment.

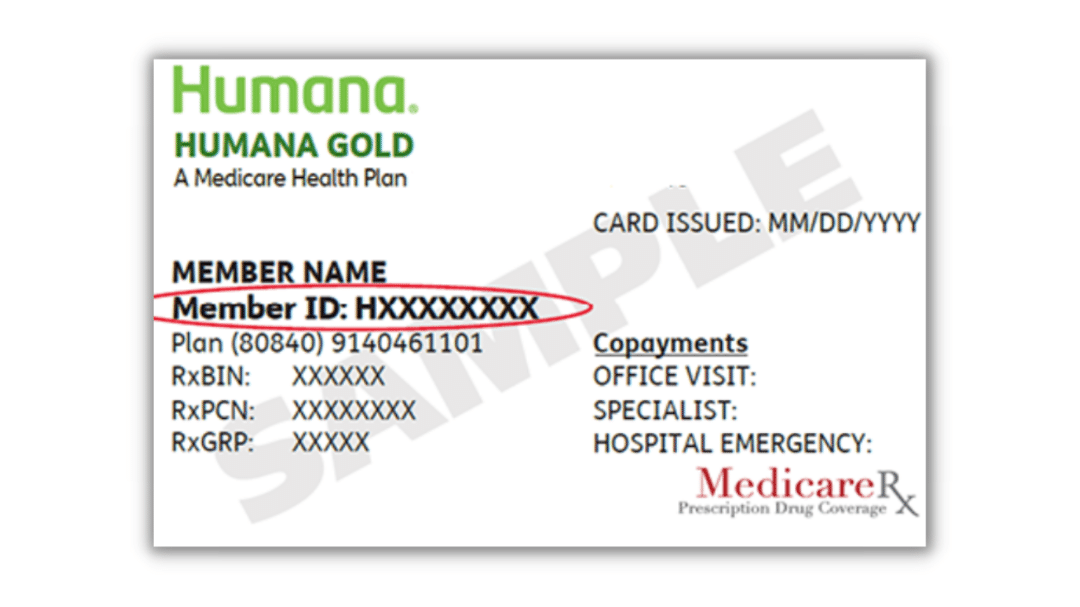

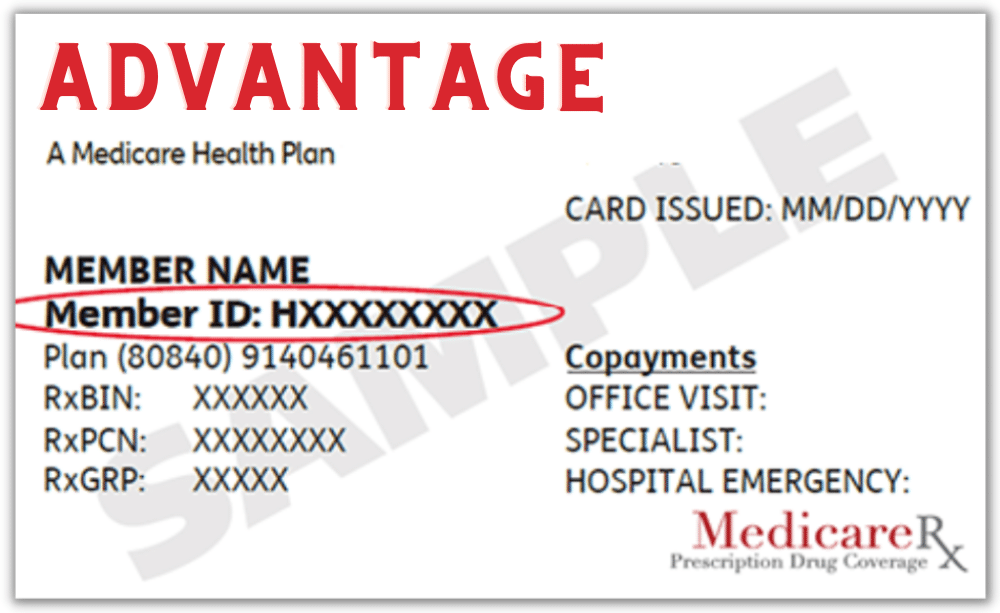

What is the difference between Medicare Supplements and Medicare Advantage? Medicare Supplements are secondary insurance policies to Medicare A & B. In this case you keep Traditional Medicare as your primary insurance. Medicare Advantage plans, also known as Part C, are when your Medicare is replaced by a private insurance provider. In this case you have one plan package that includes all of your benefits. Inquire with your agent for more details.

If I choose a Medicare Supplement, can I change to an Advantage Plan later and vice versa? If you start with a Medicare Supplement you can change to an Advantage Plan during your next valid open enrollment period. These occurr annually or in special situations. If you start with an Andvantage Plan and want to change to a Medicare Supplement later; you may have to answer health questions and qualify.