Medicare Supplement (Medigap) Key Benefits

More financial security and peace of mind by having low out of pocket medical bills.

Better access to quality healthcare by reducing your financial burden.

Doctor & healthcare choice. Standard plans cover you at any doctor or medical provider that accepts Medicare. There are no networks.

5 Things To Know About Medicare Supplements (Medigap)

To provide a better understanding of Medicare Supplements, here are some important things you should know.

- Each plan is represented by a letter, which means the how much coverage you have or how much out of pocket you’re responsible for.

- Medicare Supplement Plans are offered by various private insurance companies. The coverage for each letter plan is the same at each insurance company that offers it. Rates and the quality of the company, however, can vary among the insurance providers.

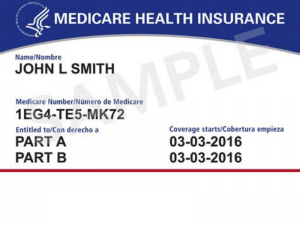

- When you have a Medicare Supplement policy it is secondary to Medicare A & B. Medicare receives and approves claims first, then forwards them to your Medicare Supplement insurer. Your plan must pay its part of all Medicare A & B approved claims.

- With standard Medicare Supplements, you are covered any doctor or medical provider that accepts Medicare A & B. There are no doctor networks.

- Once you have a Medicare Supplement policy, it is guaranteed to renew each year as long as you pay your premium. Your policy can never be canceled based on your age or health.

How Medicare Supplements (Medigap) Work

- Medicare A & B is your primary medical insurance.

- Medicare processes and approves claims.

- Medicare forwards claims automatically through an electronic system to your Medicare Supplement provider.

- Your Medicare Supplement insurer receives claims from Medicare.

- They process claims based on Medicare’s instructions (Medicare Supplement insurers do not authorize claims themselves).

- Claims are paid directly to your doctors and medical providers without paperwork on your part.

Medicare Supplement (Medigap) Plans & Coverage

As mentioned above, each Medicare Supplement Plan is represented by a letter, which means the amount of coverage you get. Medicare Supplement plans cover everything under Medicare A & B, so the amount of coverage you get with them essentially means how much in out of pocket costs you’re responsible for. There are many Medicare Supplement letter plans listed, however, there are only a few that most people choose from. The chart below shows you the coverage for the three most popular Medicare Supplements; Plan F, Plan G, and Plan N.

| Part A & B Costs | Plan F | Plan G | Plan N |

|---|---|---|---|

| Covers All Part A Hospitalization And Nursing Facility Deductibles & Co-insurance | Yes | Yes | Yes |

| Provides 365 Additional Lifetime Hospital Days Paid At 100% (Over And Above Medicare) | Yes | Yes | Yes |

| Covers Part B 20% Co-insurance? | Yes | Yes | Yes |

| Covers Part B Deductible | Yes | No | No |

| Covers Part B Excess Charges (Amounts Billed By Doctors Over Medicare’s Fee For Service) | Yes | Yes | No |

| Are There Co-Pays After Deductible? | None | None | $20 Doctor / $50 Emergency Room |

| Your Annual Out Of Pocket Liability For Part A & B Medical Expenses | Plan F covers all Medicare A & B deductibles & co-insurance, so your annual liability is $0. | Part B Deductible Only Which Is $240 Per Year In 2024 Zero Liability After Deductible | Part B Deductible, $240 In 2024 $20 Doctor Copay / $50 ER Excess Charges If They Occur |

*Click Here to compare rates for these plans.

*Click Here for profiles on our top insurance providers.

*Note: Medicare Supplement Plan F is still available for those who started Medicare prior to January 1st 2020. If you started Medicare Part A after this date, it is not available. Inquire with us for details.

Medicare Supplement Plan Descriptions

Medicare Supplement Plan F

Plan F covers 100% of Medicare A & B deductibles & co-insurance. It is the most coverage available, if you’re eligible. Plan F is still available for those who started Medicare Part A prior to January, 2020. If you started Medicare after that, it’s not available to you. The good news for those who want premium coverage is that Plan G is still available. Many of those who still have Plan F as an option have chosen Plan G.

Medicare Supplement Plan G

In recent years, Medicare Supplement Plan G has been the most popular plan. It covers all deductibles & co-insurance under Medicare A & B except the annual Part B deductible, which is $240 a year in 2024. So, if you have a Plan G policy, the annual Part B deductible is the only medical cost you are liable for. You have no deductibles or co-insurance after the deductible is met.

Medicare Supplement Plan N

Plan N is known as the value Medicare Supplement. It provides coverage similar to Plan G and a lower monthly premium. With Plan N, just like Plan G, you are responsible for the annual Part B deductible ($240 a year in 2024). After you meet your annual deductible, with Plan N, you have copays for the doctor and emergency room. With Plan G, you have no copays after the deductible. There is one more difference in coverage between N and G. Plan N does not cover Part B “Excess Charges” if they occur. These are costs when a doctor bills over the fee Medicare pays them for their services. Part B Excess Charges are rare, and when they occur, they are typically minimal. Plan N is a good option for those who want good coverage but also want keep their monthly premium as low as possible.

How To Choose A Medicare Supplement Plan

1. Review & understand how Medicare Supplements work and the coverage for top plans. Remember, there are 3 plans that most people choose from. In reality, 2 of the 3 options are most often chosen; Plan G or Plan N. The plans are very similar with slight differences in coverage and monthly cost.

2. Get a quote. Find out how much you’ll pay for the different plans. Rates are based on your age, zip code, sex, and possibly other factors such as if you smoke or use tobacco. There are also discounts available and we’ll help you maximize them. Click Here to get instant, personalized rates or call us at 512-537-7847.

3. Pull it all together. Weigh the coverage and monthly cost to determine which plan is best for you. If you would like to have more coverage, don’t want to think about copays, and don’t mind paying a little bit more monthly; Plan F or G may be your best option. If you don’t mind copays, don’t go to the doctor too often, and/ or would prefer a lower monthly cost; Plan N might be a better fit for you. Once you know which plan you want, you’ll just need to choose a quality insurance carrier with a competitive rate. We’re here to help. Our service is zero cost and we’ll help guide you to choosing your best option. Just give us a call at 512-537-7847 or Click Here to request information.