Guide Contents

These are the sections of this guide that appear in order on this page.

- Medicare & CHAMPVA – Important Facts To Know

- The Parts Of Medicare

- Medicare Advantage

- Standard Medicare Vs. Medicare Advantage

- Request Info On Available Plans & Benefits

- Featured Heroes Testimonials

- General Frequently Asked Questions

- Medicare Advantage Frequently Asked Questions

Medicare And CHAMPVA

As a spouse or dependent of a disabled or deceased military service member, you may be covered by CHAMPVA. Prior to becoming eligible for Medicare, you’ve more than likely been using this as your main coverage. But, when you become eligible for Medicare at age 65, this changes. When you start Medicare it will be your primary medical insurance and CHAMPVA will become your secondary. As a CHAMPVA recipient, it’s important to know that when you become eligible, you must enroll in Medicare A & B.

Important Medicare & CHAMPVA Facts

- When you become eligible, Medicare becomes your primary medical insurance and CHAMPVA your secondary.

- CHAMPVA covers deductibles & co-pays with Medicare, so you are 100% covered for Medicare covered medical services.

- You can receive Medicare coverage directly through the government (Original Medicare) or through private health plans known as Medicare Advantage.

- When you start Medicare, CHAMPVA continues to provide you with prescription coverage. You also have the option of getting prescription coverage under Medicare, which will affect your mail order prescription benefits under CHAMPVA.

- CHAMPVA can be your secondary insurance to Original Medicare or Private Medicare Advantage. So, you have a choice between the two.

Need To Know

When you’re eligible, you must sign up for Medicare to maintain your CHAMPVA benefits.

The Parts Of Medicare

Medicare has 5 parts, with the main ones being Parts A & B. Medicare Part A covers inpatient hospitalization, skilled nursing facility, and home health care. Medicare Part B covers doctors, outpatient treatment and testing. At a minimum you’ll want parts A & B and you can select from the 3 other parts based on your wants & needs.

The Other 3 Parts

- Part C – More commonly known as Medicare Advantage, these are private insurance plans. You have the choice of being covered directly through Medicare or a Private Insurer.

- Part D – Medicare prescription pharmacy benefits. Medicare does not provide coverage directly but instead through private insurers.

- Supplements – Medicare Supplements are insurance plans that supplement Medicare A & B. They are offered by private insurers and help cover medical costs. CHAMPVA provides the same function, so in most cases, Medicare Supplements aren’t needed by CHAMPVA recipients.

In many cases CHAMPVA provides prescriptions at an affordable cost, however, in some cases it’s beneficial to have drug coverage under Medicare as well.

Medicare Advantage

How CHAMPVA Recipients Get The Most Medicare Benefits For The Lowest Cost

As a Medicare recipient, you have the choice of getting your benefits directly through the government (Original Medicare) or through a private insurer (Medicare Advantage). Medicare Advantage are health plans provided by private insurers. Both Original Medicare and Medicare Advantage include Part A coverage for hospitalization and Part B for doctors & outpatient care. Original Medicare is “one size fits all” and the same for everyone in the country. Medicare Advantage, however, gives you various choices that may be a better fit for your unique situation. The “Advantage” in Medicare Advantage is that they include more benefits than Original Medicare, at the same or lower monthly cost. The additional benefits you can get with Medicare Advantage include;

- Dental, Vision, and Hearing Aid coverage.

- Silver Sneakers – Gives you free access to exercise facilities and online exercise videos.

- Part B Giveback – This is a benefit included with some plans that gives you a monthly dollar amount to help you pay your Medicare cost.

- Prescription – There are Medicare Advantage options that include pharmacy coverage and some that do not. You have choices.

In most areas there are specific plans designed with Veterans & Military in mind. Because there are so many plans available, the best options for Veterans, Military, & their Families are often lost in the crowd. Contact us and we’ll make it easier for you by helping you cut through all the clutter.

Need To Know

CHAMPVA can be your secondary insurance to Original Medicare or Private Medicare Advantage. You have a choice between the two.

For questions & details on available programs

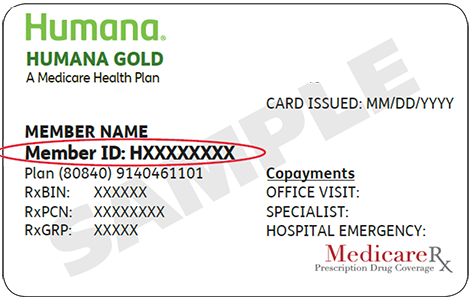

Medicare Advantage Vs. Original Medicare Comparison

To get a better idea of how Medicare Advantage and Original Medicare compare, here is a comparison chart of the different features. As we’ve said, Medicare Advantage is available with and without prescription coverage.

| Feature | Original Medicare | Medicare Advantage |

|---|---|---|

| Total Monthly Cost | $170.10 In 2022 | $90 To $170.10 In 2022 |

| Hospitalization & Doctors | Yes | Yes |

| Doctor Networks | No Networks | Yes: PPO & HMO |

| Rx Included | No | Some With & Without |

| Dental & Vision | No | Yes |

| Hearing Aid | No | Often Included |

| Fitness Club / Gym Membership | No | Yes |

Best viewed on a laptop, desktop, or tablet device.

This table provides a general overview & comparison of Original Medicare & Medicare Advantage. Benefits & costs vary with different plans. Refer to plan specific documents such as the Summary of Benefits. Contact us for details.

Part B Giveback $

Part B Giveback is a rebate that Retired Military, Veterans, and their Families can take advantage of to lower their monthly cost of Medicare.

For questions & details on available programs

Featured Heroes Testimonials & Profiles

About our Veteran & Military clients and what they have to say

On a mobile phone, swipe with your finger to the left to move to the next profile.

Top Medicare Insurers For Veterans & Families

We offer these providers & more