Medicare Advantage Plans are health insurance programs provided by private insurance carriers. In addition to Traditional Medicare, they are one of two ways to receive your Medicare coverage. Many people who have Traditional Medicare, also have a Medicare Supplement and a Part D plan. As an alternative to Traditional Medicare and a supplement, these days many people are choosing to go with Medicare Advantage plan. The reason for this is that Medicare Advantage Plans can include more benefits than Traditional Medicare, for little or no extra cost.

Medicare Advantage benefits can include;

1. Manageable co-pays for doctors visits and other medical care with annual out of pocket maximums. This helps limit your out of pocket medical costs during any given year, something Traditional Medicare doesn’t have by itself.

2. Part D prescription coverage built into the plan.

3.Extra benefits such as dental, vision, hearing, and gym memberships.

Although Medicare Advantage plans can provide these extra’s, and are a great value in my opinion; There are still some holes you can fill. You still have copays when you see doctors, are hospitalized, or have other types of medical care. Your most expensive co-pays can occur if you are hospitalized, in a rehab facility, or if you are being treated for a critical illness. I will address the specifics on these later in the article.

Unlike Traditional Medicare, with Medicare Advantage, there is no specific supplemental insurance that helps pay your Medical bills directly. Plus, you should understand that you can only have a standard Medicare Supplement policy if you have Traditional Medicare. They do not work with Medicare Advantage. So, to have more coverage with Medicare Advantage, you have to get creative. Fortunately there are ways to do it, and do it affordably. Here are 3 ways to fill the gaps in Medicare Advantage Plans.

1. Hospital Indemnity Policies

Hospital Indemnity Plans are insurance policies that pay you a cash benefit if you are hospitalized or in a Rehab / Nursing Facility. Payments can include an initial cash benefit and a daily benefit for each day you are hospitalized. Cash benefits are paid directly to you, or in some cases, you can assign them to the hospital. If you have a Medicare Advantage plan, a Hospital Indemnity Policy can help you cover the copays you would incur for being hospitalized.

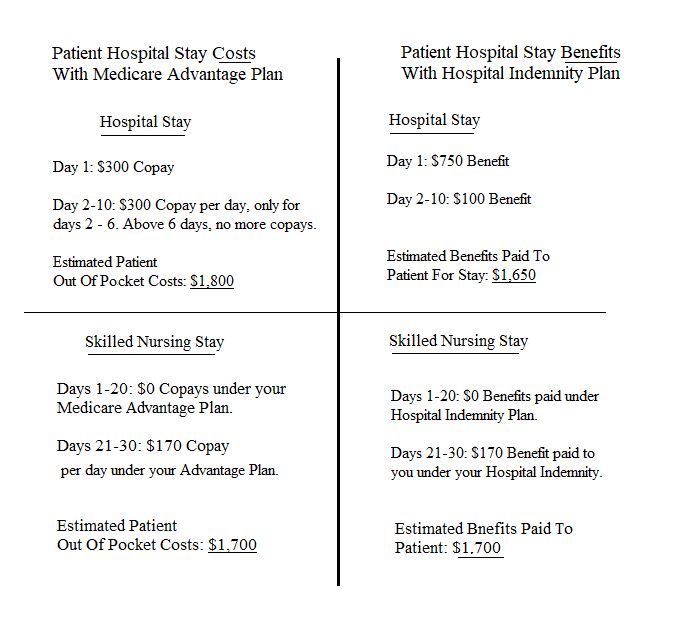

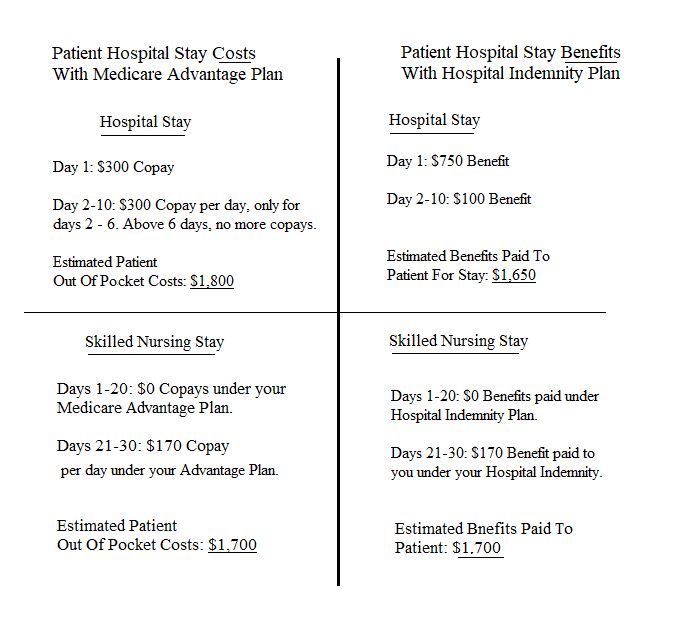

Under most Medicare Advantage Plans, you will have a daily copay for being hospitalized. These copays can range anywhere from $250 to $400 per day. The number of days that you have a copay are usually limited to 4 – 7 days. This means that you’ll only have a daily copay for a certain number of days. Over and above those days, you won’t have any additional copays and your Advantage Plan covers you 100%.. Although the number of days are limited, your copays can still add up to a relatively high number. Here’s an example of someone who has a hospital stay while covered by a Medicare Advantage plan and a Hospital Indemnity policy. This situation is for someone who has a 10 day hospital stay followed by 30 days in a Rehab/Nursing facility.  As you can see, having a Hospital Indemnity plan can really help in this situation. Although this is just an example, I have seen real life situations very similar to this one. Needless to say my clients were grateful that they had the Hospital Indemnity coverage. By paying you a cash benefit if you are hospitalized; Indemnity insurance can help protect your savings and from having to pay large out of pocket costs.

As you can see, having a Hospital Indemnity plan can really help in this situation. Although this is just an example, I have seen real life situations very similar to this one. Needless to say my clients were grateful that they had the Hospital Indemnity coverage. By paying you a cash benefit if you are hospitalized; Indemnity insurance can help protect your savings and from having to pay large out of pocket costs.

2. Critical Illness Policies

Critical Illness insurance pays a lump sum cash benefit to the insured if they are diagnosed with a covered serious illness. The illnesses that are covered vary among plans but usually consist of; Cancer, heart attack, stroke, and other serious illness. Being diagnosed with a critical illness can happen to any of us and causes serious disruption to our lives. These situations usually require frequent medical care including; Surgery, hospitalization, doctors visits, chemotherapy, and others. As you may be able to guess, this type of care can be on the more expensive end.

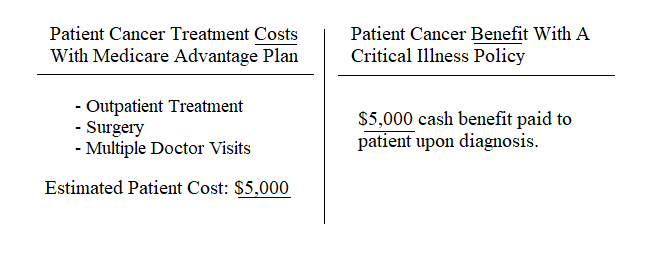

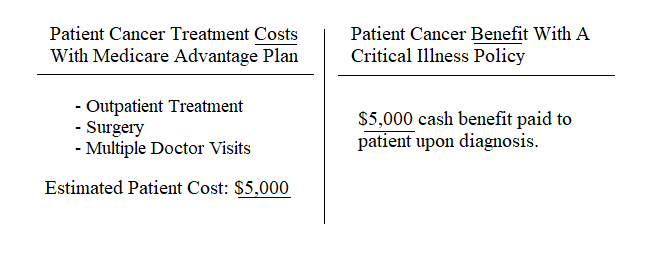

When you are covered by a Medicare Advantage plan, you will have a copay or coinsurance when you receive treatment. You will be liable for these copays and coinsurance up to your annual out of pocket maximum. This is the cap on your out of pocket medical costs during any given calendar year. After you reach your annual maximum, your Medicare Advantage plan covers 100% of your medical costs for the remainder of the year. Even though there is a cap, it usually ranges anywhere from $3,000 to $7,000; depending on your plan. This is a relatively high number and most of us don’t have that kind of cash lying around for medical expenses.

As I said earlier, Critical Illness policies pay you a cash benefit if you’re diagnosed with a covered critical illness. For someone covered by a Medicare Advantage plan, a Critical Illness policy with benefits in the amount of $5,000 to $15,000 should be sufficient. This would provide you with the funds to pay out of pocket costs up to or above your out of pocket maximum. Let’s take a look this example where someone is diagnosed with cancer who has a Medicare Advantage plan and a Critical Illness policy.

As you can see in this situation, a Critical Illness policy can help you cover large out of pocket expenses that could reach into the thousands of dollars. It’s very likely that the treatment costs for this situation would end up reaching the individual’s out of pocket maximum for the year. The reality is, we just never know if or when this can happen to us. Having Critical Illness coverage can really be a relief and could quite literally be a life saver.

As you can see in this situation, a Critical Illness policy can help you cover large out of pocket expenses that could reach into the thousands of dollars. It’s very likely that the treatment costs for this situation would end up reaching the individual’s out of pocket maximum for the year. The reality is, we just never know if or when this can happen to us. Having Critical Illness coverage can really be a relief and could quite literally be a life saver.

3. Life Insurance

As of 2019, Social Security pays beneficiaries a one time death benefit of $255. With the ever so rising cost of final expenses, this isn’t nearly enough. Medicare Advantage plans also do not provide any life or final expense coverage. According to Lincoln Heritage, a major funeral insurance provider, the average funeral / burial cost is $7,000 to $9,000 in 2019. For cremation, the average cost is $6,000 to $7,000. These costs vary based on one’s personal wishes, but rest assured they will add up into the thousands. So, what can you do?

Well, the first option of course, is to avoid the issue and hope it takes care of itself. As you may have experienced, avoiding something rarely solves anything and often times makes things worse. The reality is, when we die, we won’t be here to worry about worldly issues. But, more than likely, someone we love will. This can include our spouse, children, brother, sister, cousin, parent, or even a dear friend. Without a plan to pay for final expenses, the financial burdens will more than likely fall on one of these people. Fortunately, with a little pre-planning, you can take care of the problem and continue a life with less worry. This is what life insurance is for. There are many good options out there that are not only affordable but hassle free. The two main types of life insurance are term and whole life. In many cases, for the need addressed in this article, whole life is the best solution. So, let’s take a look at that.

Final Expense Whole Life

Final Expense Whole Life insurance is a type of life insurance policy that is specifically designated to cover final expenses. Policy amounts usually range between $5,000 and $25,000 and are a simple way to pre-plan. Here are a few features and benefits;

- Pays a cash benefit, upon death, to the person you designate as your beneficiary to handle your affairs.

- Because the policy is “whole life,” the benefits and monthly cost are locked in for life. You can keep the policy indefinitely so it’s stable.

- No medical examination, only a simple application with questions about your medications and health.

- In many cases you are covered immediately or at worst a modest waiting period.

- Reasonable, affordable monthly rates.

Life Insurance With Living Benefits

With life insurance there is a way to “kill two birds with one stone” (no pun intended) and get critical illness insurance built into your policy. Earlier in the article I reviewed Critical Illness insurance as a policy that pays you a cash benefit if diagnosed with a covered illness. Critical illness insurance can be provided as an individual policy or built into life insurance as an added benefit. When it’s built into a life insurance policy is called life insurance with “living benefits.” So, the life insurance not only pays a lump sum benefit to your beneficiary if you pass; It can pay you if you are diagnosed with a serious illness. Hence, killing 2 birds with one stone.

If you have a claim for critical illness, your life insurance policy will be reduced by the amount you receive. For example; Let’s say you have a $15,000 life insurance policy and you file a $5,000 critical illness claim due to being diagnosed with cancer. After the payout, your life insurance policy will now be worth $10,000. So, you still have the $10,000 policy and you get the funds you need now.

Conclusion

Depending on your situation, Medicare Advantage plans can be a great way to be covered under Medicare. You can get a lot of extra benefits, for little or no extra monthly premium (in addition to what you already pay for Medicare). You may be covered by a Medicare Advantage plan now or are considering it. In any case, it’s important to understand the coverage & costs. If you have medical treatment, you can expect to pay out of pocket costs in the form of copays or coinsurance. These costs can add up, especially if you’re hospitalized or need treatment for a critical illness. Hospital Indemnity, Critical Illness, and Life Insurance are 3 great ways to fill these gaps in Medicare Advantage. For just a little more of a monthly premium, you could have the extra coverage and peace of mind the these plans offer.

The insurance plans mentioned in this article are subject to eligibility and qualification.

Please reach out to us and request information on this site by Clicking Here. You call us at 855-625-7633 7 days a week.

Thanks for reading.

As you can see, having a Hospital Indemnity plan can really help in this situation. Although this is just an example, I have seen real life situations very similar to this one. Needless to say my clients were grateful that they had the Hospital Indemnity coverage. By paying you a cash benefit if you are hospitalized; Indemnity insurance can help protect your savings and from having to pay large out of pocket costs.

As you can see, having a Hospital Indemnity plan can really help in this situation. Although this is just an example, I have seen real life situations very similar to this one. Needless to say my clients were grateful that they had the Hospital Indemnity coverage. By paying you a cash benefit if you are hospitalized; Indemnity insurance can help protect your savings and from having to pay large out of pocket costs. As you can see in this situation, a Critical Illness policy can help you cover large out of pocket expenses that could reach into the thousands of dollars. It’s very likely that the treatment costs for this situation would end up reaching the individual’s out of pocket maximum for the year. The reality is, we just never know if or when this can happen to us. Having Critical Illness coverage can really be a relief and could quite literally be a life saver.

As you can see in this situation, a Critical Illness policy can help you cover large out of pocket expenses that could reach into the thousands of dollars. It’s very likely that the treatment costs for this situation would end up reaching the individual’s out of pocket maximum for the year. The reality is, we just never know if or when this can happen to us. Having Critical Illness coverage can really be a relief and could quite literally be a life saver.